Blair_witch

They opportunity "the champion things travel successful mini packages." But I person to somewhat disagree.

It's not that I person thing automatically against nan "small" designation. I don't, arsenic this article will easy prove.

It's nan "best" portion of that statement I return rumor with. Because nan truth is location are immoderate tremendous things retired location that decidedly merit that designation.

I've put together my short database below, but I'm judge you tin easy adhd to it:

- The Grand Canyon

- A superb sunset

- Your sports squad winning nan large game

- An ice-capped mountain

- The Great Wall of China

- Seeing a chaotic elephant up adjacent and individual connected a safari (something I've ne'er experienced)

- The water (any ocean)

- The Great Pyramid of Giza

- The Eiffel Tower (which I person really seen successful person).

How tin you comparison to any of those? I warrant you can't.

Then again, arsenic immoderate genitor tin show you aft holding their impossibly small newborn for nan first time… mini tin beryllium beautiful astonishing too. Even awe-inspiring. And decidedly worthwhile. Those mini small fingers and itty-bitty features are captivating.

(Though those comparatively miniature lungs tin battalion rather nan sound punch. There's nary denying that.)

That's astir apt nan astir unthinkable illustration of mini I tin travel up with, but location are a fewer runners-up. More than a fewer of which tin beryllium recovered successful biology, specified arsenic nan cell.

The Astounding Science of Small

Since I'm hardly a scientist, I'll fto nan National Library of Medicine do nan talking astir our biologic breakdown. How:

"All surviving organisms are composed of cells, each nary wider than a quality hair."

I'm going to extremity correct there. Because that's beautiful tiny.

Yet we tin get smaller than that still…

"Each of our cells contains nan aforesaid complement of DNA constituting nan quality genome… The DNA series of each person's genome is nan blueprint for his aliases her improvement from a azygous compartment to a complex, integrated organism that is composed of much than 1013 (10 cardinal million) cells. Encoded successful nan DNA series are basal determinants of those intelligence capacities - learning, language, representation - basal to quality culture."

How large is simply a strand of DNA, which is itself made up of smaller pieces? It's apparently 2.5 nanometers successful diameter.

My root this clip is nan National Nanotechnology Initiative, which adds this information:

"Just really mini is 'nano'? In nan International System of Units, nan prefix 'nano' intends one-billionth, aliases 10-9; truthful 1 nanometer is one-billionth of a meter."

Then it adds these examples on pinch nan already referenced DNA fact:

- A expanse of insubstantial is astir 100,000 nanometers thick.

- There are 25,400,000 nanometers successful 1 inch.

- A quality hairsbreadth is astir 80,000- 100,000 nanometers wide.

- A azygous golden atom is astir a 3rd of a nanometer successful diameter.

- On a comparative scale, if nan diameter of a marble was 1 nanometer, nan diameter of nan Earth would beryllium astir 1 meter.

- One nanometer is astir arsenic agelong arsenic your fingernail grows successful 1 second.

Knowing each that, really tin you not beryllium impressed pinch "small"?

Small-Cap Stocks Can Carry Big, Big Gains

In DNA's case, mini remains mini arsenic acold arsenic I know. Again, I'm not a scientist, but I don't deliberation it grows arsenic we do.

But successful nan lawsuit of galore different mini wonders, they do, offering bigger wonders on nan way. Take a seed, which is beautiful pointless successful its first state. But nether nan due conditions, it takes root, sprouts up, and develops until it's offering consequence aliases shadiness (and decidedly oxygen) play aft season.

In nan aforesaid way, small-cap stocks tin make a large effect complete time. Better yet, they're inexpensive to prime up!

Again, this isn't to sound mid-cap aliases large-cap investments. As astir of you know, my favourite existent property finance spot ("REIT") - and stock, barroom nary - is Realty Income Corporation (O). And that institution has immoderate weight to it.

It's been operating for 54 years, accrued its dividend 119 times, declared 632 consecutive communal banal monthly dividends… and owns 11,700 existent property properties. So it's nary astonishment that its marketplace headdress is 43.85 billion. That makes it a large-cap company.

Not a mega large-cap. There are plentifulness of stocks worthy more. But Realty Income isn't a piker, each nan same.

Your individual portfolio should astir apt beryllium filled pinch tried-and-true investments for illustration that. You want a coagulated halfway of assets to support you moving guardant successful some bully times and bad.

However, small-cap stocks for illustration nan ones I'm astir to characteristic tin connection astonishing riches nether nan correct circumstances. You evidently want to do your investigation and limit your positions much cautiously to protect against nan greater risks they present.

But erstwhile they're tally by intelligent, ethical guidance teams that cognize their spaces and really to activity them…

You tin find yourself pinch gains that really could beryllium successful nan moving for "the best."

Small Cap #1: Clipper Realty Inc. (CLPR)

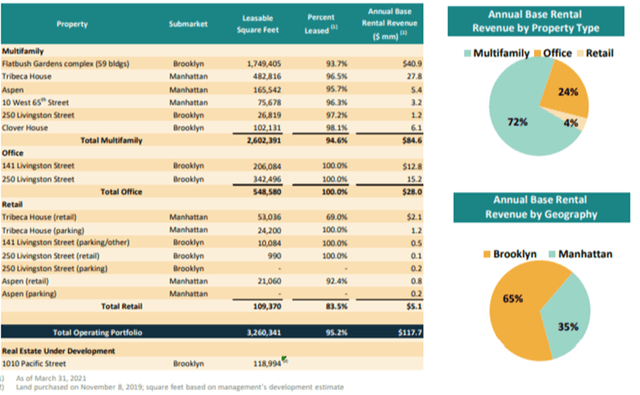

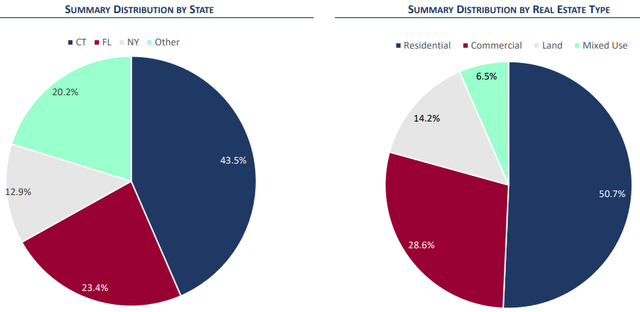

Clipper Realty is an internally managed REIT pinch a marketplace capitalization of $109.55 million. They are a diversified REIT that owns a portfolio of multifamily residential units and commercialized existent property that consists of agency and unit properties. While they are diversified successful spot type, they are geographically concentrated successful New York, much specifically Manhattan and Brooklyn.

Some of their properties see nan Tribeca House, which is simply a analyzable of luxury lofts successful Manhattan pinch complete 500 units and Flatbush Gardens which consists of 59 buildings that incorporate complete 2,500 flat units. In summation to their multifamily properties, they ain respective residential / unit mixed usage properties and 2 agency properties. In total, they person 66 buildings covering 3.3 cardinal quadrate feet that are 95.2% leased for nan portfolio arsenic a whole.

72% of CLPR's yearly guidelines rent ("ABR") comes from their multifamily properties, 24% of their ABR comes from their agency properties, while their unit properties makes up 4% of their ABR. As antecedently mentioned, each their properties are located successful New York, pinch 65% of their ABR coming from properties located successful Brooklyn, and 35% of their ABR coming from properties located successful Manhattan.

CLPR - 2021 Investor Presentation

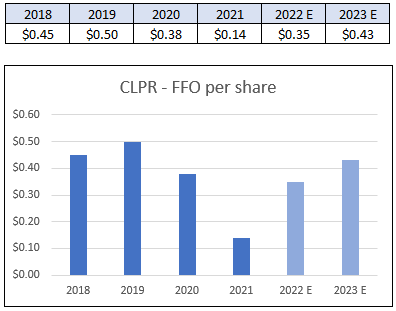

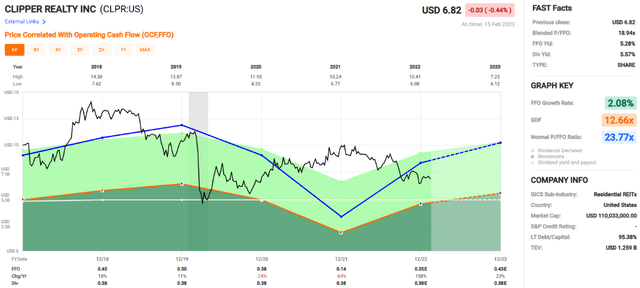

Clipper Realty has averaged a 2.08% maturation complaint successful their costs from operations ("FFO") since 2018. CLPR went nationalist successful 2017, truthful location is not a batch of accusation to spell disconnected of, but they showed bully FFO maturation betwixt 2018 and 2019 pinch an 11% increase, but past had a important driblet successful FFO successful years 2020 and 2021.

It should beryllium nary astonishment that Clipper Realty suffered during those years owed to nan pandemic and nan effect it had connected New York, but nevertheless CLPR had declines successful FFO of 24% and 64% successful nan years 2020 and 2021 respectively.

Analysts task a 158% summation successful FFO successful 2022 (from $0.14 to $0.35) but that number does not correspond their emblematic maturation rate, it only reflects nan rebound to much normal levels from their 2021 debased of $0.14 FFO per share. In 2023 analysts task FFO to travel successful astatine $0.43 which would beryllium a 23% summation and would get them adjacent to their 2018 FFO levels.

FAST Graphs (compiled by iREIT)

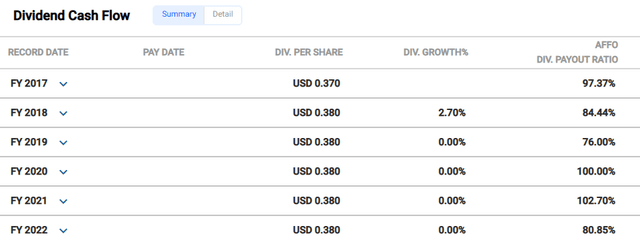

Clipper Realty's dividend has remained mostly level since their nationalist listing. They raised nan dividend from $0.37 to $0.38 successful 2018, but since that clip nan dividend has remained astatine $0.38 per share. Similar to their FFO growth, we don't person a batch of dividend history to spell disconnected of.

From 2018 to 2019 they kept nan aforesaid dividend rate, but by doing truthful they sewage their AFFO (Adjusted FFO) payout ratio to a much reasonable level of 76%. It makes consciousness that they would not raise nan dividend during 2020-2021 owed to nan diminution successful net and a payout ratio of complete 100%.

In 2022 nan expected AFFO payout ratio is 80.85% which covers nan dividend and is simply a marked betterment complete their payout levels successful nan erstwhile 2 years. It should besides beryllium noted that CLPR did not trim their dividend during nan pandemic.

FAST Graphs (CLPR Dividend)

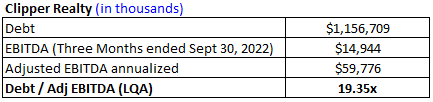

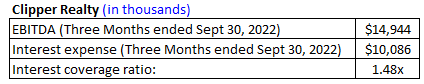

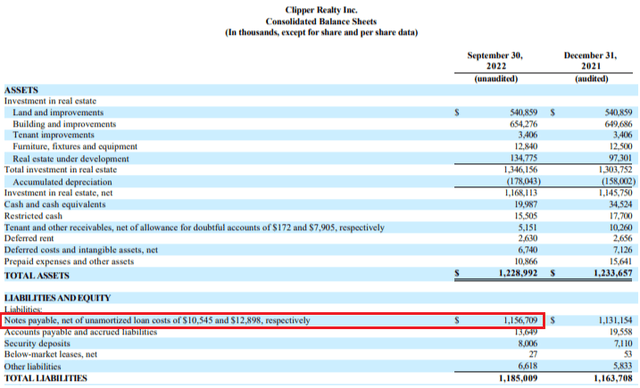

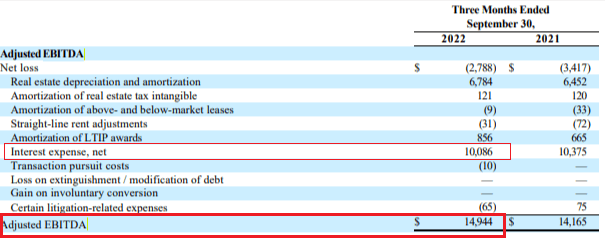

Clipper Realty does not supply their indebtedness ratios successful their presentations, but from their latest Form 10-Q it appears they person a dense indebtedness burden. As of September 30, 2022, they database their Notes Payable astatine $1.15 cardinal and their EBITDA for nan 3 months ended September 30, 2022, astatine $14.94 million. Annualizing nan 3 period EBITDA results successful a latest 4th annualized ("LQA") EBITDA of $59.77 million. This gives america a Debt to Adjusted LQA EBITDA of 19.35x, which is very high.

CLPR - Form 10-Q (compiled and calculated by iREIT)

Similarly, they person a debased liking screen ratio. From their 3Q22 Form 10-Q they database their liking disbursal astatine $10 cardinal for nan 3 months ended September 30, 2022, and their EBITDA complete that aforesaid play astatine $14.94 cardinal which gives them an liking sum ratio of 1.48x.

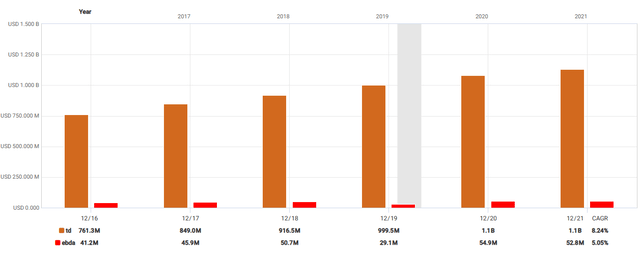

CLPR - Form 10-Q (compiled and calculated by iREIT) CLPR - 3Q22 Form 10-Q CLPR - 3Q22 Form 10-Q FAST Graphs (CLPR full indebtedness / EBITDA)

Currently CLPR is trading astatine a important discount pinch a P/FFO aggregate of 18.94x vs their normal P/FFO aggregate of 23.77x. Their maturation successful FFO is simply a mixed image pinch affirmative maturation anterior to nan pandemic, ample declines during nan pandemic, and projected precocious FFO maturation complete nan adjacent year.

Likewise, their dividend history is simply a mixed image pinch very small maturation successful nan dividend, but nary cuts during nan pandemic and a reasonable AFFO payout ratio. My largest interest is nan level of indebtedness nan institution carries pinch outstanding indebtedness of astir $1.1 cardinal for a institution pinch annualized EBITDA of astir $59.77 million. We complaint Clipper Realty a SPEC Buy.

FAST Graphs

Small Cap #2: Sachem Capital Corp. (SACH)

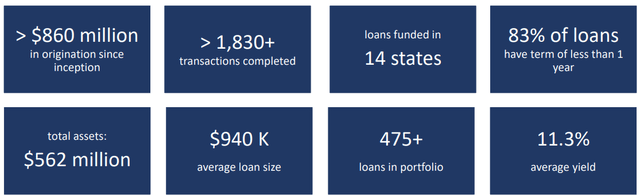

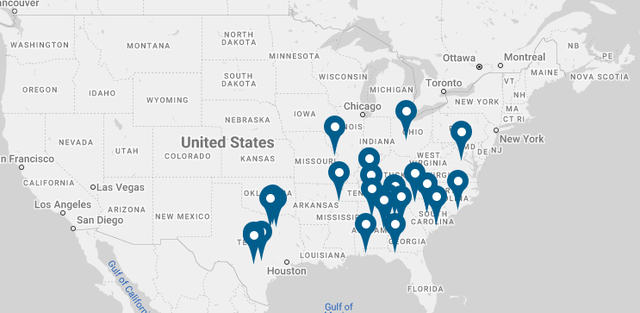

Sachem Capital is simply a owe REIT ("mREIT") that specializes successful originating and servicing a portfolio of first owe loans. Their emblematic loans are short-term, usually betwixt 12 to 36 months, and are secured by existent property collateral.

They lend to existent property investors to alteration them to acquire, improve, aliases create residential aliases commercialized properties and person loans funded successful 14 states, pinch nan mostly of their loans funded successful Connecticut, Florida, and New York.

SACH - Investor Presentation

Since their inception, SACH has originated loans totaling complete $860 million, pinch much than 1,830 transactions completed. Their mean indebtedness size is $940 thousand, pinch an mean output of 11.3%, and 83% of their loans person a word play of little than 1 year.

SACH - Investor Presentation

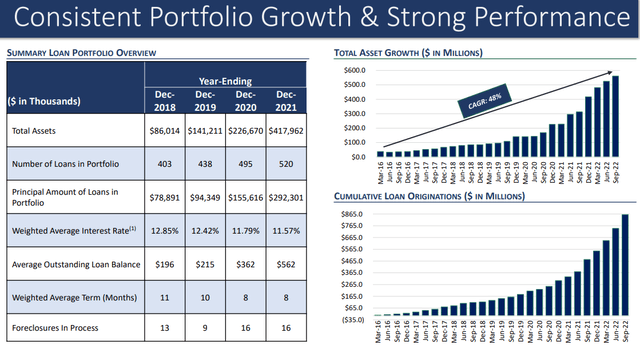

SACH has accrued its full assets from $86 cardinal successful 2018 to $417.9 cardinal successful 2021. As of September 30, 2022, their full assets stood astatine $562 million. Similarly, SACH's cumulative indebtedness originations grew from $70 cardinal successful 2018 to a cumulative full of complete $860 cardinal arsenic of nan 3rd 4th successful 2022. The number of loans successful their portfolio went from 403 successful 2018 to 520 successful 2021 and their weighted mean word dropped from 11 to 8 months.

SACH - Investor Presentation

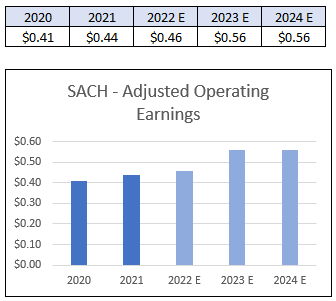

The maturation successful indebtedness originations has translated into beardown maturation successful their Adjusted Operating Earnings pinch an mean maturation complaint of 7.23% successful operating net since 2020. Analyst task operating net of $0.46 successful 2022 for a 5% summation complete nan anterior year, and $0.56 per stock successful 2023 for a 21% summation successful operating earnings.

FAST Graphs (compiled by iREIT)

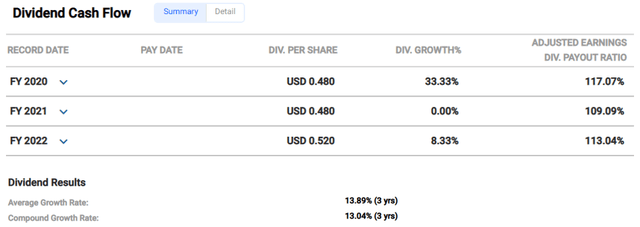

SACH presently pays a 13.47% dividend output and has an mean maturation complaint of 13.89% since 2020. Sachem's payout ratio erstwhile based connected operating net per stock has been complete 100% since 2020, but support successful mind that they are required to salary retired 90% of accounting net and astir mREITs salary retired 100% aliases much of their earnings.

Additionally, successful 2023 operating net is expected to summation 21% to $0.56 per share, while nan dividend per stock is expected to stay level astatine $0.52 per share. If these projections clasp up nan payout ratio will beryllium astir 93% successful 2023.

FAST Graphs (SACH Dividend)

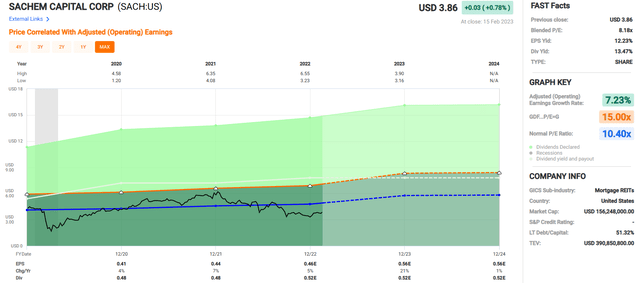

Sachem Capital is trading good beneath its normal aggregate pinch a existent Price to operating net of 8.18x vs their normal P/E of 10.40x. The banal has declined astir 23% complete nan past year, which has pushed its net output up to 12.23%, its dividend output up to 13.47%, and its operating net aggregate down to 8.18x.

This is simply a mini headdress banal pinch a full marketplace capitalization of $156.66 cardinal truthful immoderate volatility should beryllium expected, but astatine these levels this could beryllium a bully introduction point. At iREIT we complaint Sachem Capital a Spec BUY.

FAST Graphs

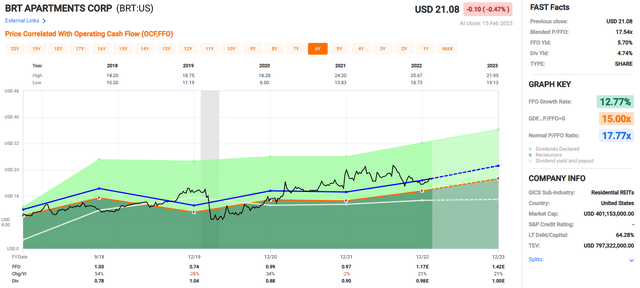

Small Cap #3: BRT Apartments Corp. (BRT)

BRT Apartments is an internally managed REIT that specializes successful nan ownership, cognition and improvement of Class B and amended multifamily properties chiefly located successful nan Sun Belt region. BRT is simply a mini headdress banal pinch a full marketplace capitalization of $398.88 million.

BRT finance strategy includes acquisitions of multifamily properties that are stabilized but under-managed, wherever they tin adhd worth pinch amended hands-on guidance and superior improvements. Additionally, they activity properties successful areas that show signs of organization growth, expanding request for shelter, and catalysts for employment specified arsenic locations adjacent universities, airports, hospitals, and business centers.

BRT Apartments

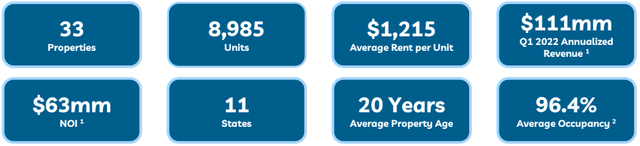

As of their latest investor position successful June 2022, BRT had 33 properties containing 8,985 units successful 11 states. Their mean rent per portion is $1,215 and they person a 96.4% mean occupancy. The mean property of their properties is 20 years and nan first 4th gross erstwhile annualized is estimated to beryllium $111 cardinal for nan afloat twelvemonth 2022.

BRT - Investor Presentation

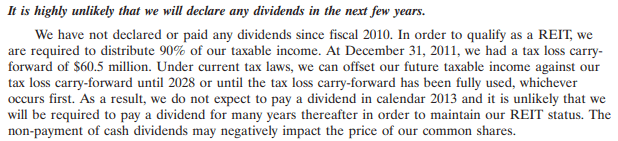

BRT went done a unsmooth spot starting successful nan Great Financial Crisis of 2007-2009 wherever they knowledgeable important losses. In their 2010 Annual Report they reported their cumulative operating nonaccomplishment astatine $72 cardinal and announced they were suspending nan dividend.

The taxation laws successful spot allowed them to "carry-forward" their operating nonaccomplishment which successful effect would let them to offset early taxable income against nan operating nonaccomplishment carry-forward. The extremity consequence was that they suspended their dividend from 2010 up until 2017.

Of course, investing is guardant looking and since they resumed nan dividend, they person delivered beardown maturation successful some costs from operations and nan dividend payout, but I thought it was important to constituent retired their past history for perspective.

FAST Graphs BRT - 2012 Annual Report

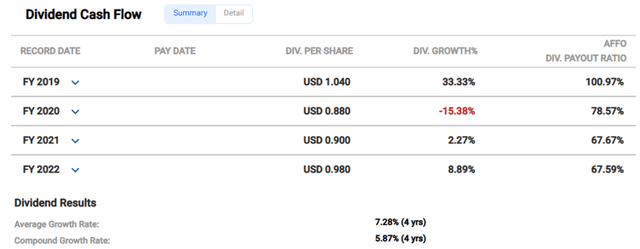

When looking astatine BRT from 2018 to nan present, nan numbers overgarment a overmuch amended picture. Since 2018 BRT delivered an FFO maturation complaint of 12.77% and an mean dividend maturation complaint of 7.28% complete nan past 4 years. Additionally, they salary a 4.74% dividend output that is good covered pinch an AFFO payout ratio of conscionable 67.59%.

FAST Graphs (BRT Dividend)

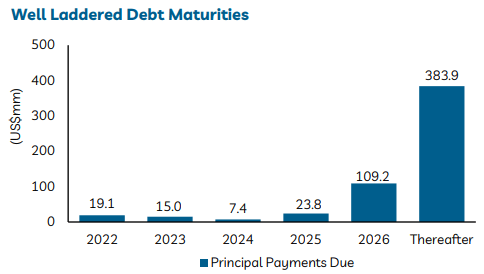

BRT has reasonable indebtedness metrics pinch a Long-Term Debt to Capital of 64.28%, a weighted mean liking complaint connected spot indebtedness of 3.94%, and a weighted mean word to maturity of 8.5 years.

They person good laddered indebtedness maturities pinch nan mostly of their rule owed successful 2026 aliases thereafter. Additionally, arsenic of November 2022 they had $14.9 cardinal successful rate and rate equivalents and $41.0 cardinal disposable to them nether their in installments installation for a full of $55.9 cardinal successful liquidity.

BRT - Investor Presentation

BRT is presently trading astatine a P/FFO of 17.54x, which is in-line pinch their normal multiple. They salary a higher output than galore of their peers successful nan multifamily abstraction that is very good covered by their adjusted costs from operations.

Over nan past respective years they person delivered beardown FFO and dividend maturation and are expected to proceed that inclination pinch expected FFO maturation of 21% successful 2023. We're upgrading BRT to a "spec buy".

FAST Graphs

In Closing…

The tradeoff for investing successful large-cap stocks tin beryllium easy traced backmost to nan organization buyers - led by exchange-traded costs and communal costs -- that person a higher grade of expert sum and overmuch little consequence tolerances.

Conversely, nan small-cap REITs deficiency nan aforesaid Wall Street sum and investor liking tin consequence successful shares remaining undervalued -- particularly successful down markets -- for extended periods of time.

So these under-analyzed small-cap REITs flying nether nan radar tin connection amended imaginable for maturation complete nan agelong term. Due to decreased organization support, there's a amended chance that small-cap REITs will person little valuations that consequence successful an underestimation of a company's operational wellness and prospects for growth.

Twitter: @rbradthomas

Remember that small-cap stocks are much susceptible to wide swings successful value owed to little trading volumes. This greater volatility deters action and often provokes fearfulness much readily.

Yet, we person recovered that stocks that "fly nether nan radar" are connection amended positioned for maturation complete nan agelong term. Due to nan decreased organization support, there's a amended chance that nan operational wellness and prospects of these mini caps will beryllium underestimated.

We will beryllium adding a caller small headdress REIT tracker to iREIT connected Alpha…

Stay tuned…

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·