Dividend trimming time.

ArtistGNDphotography/E+ via Getty Images

Get fresh for charts, images, and tables because they are amended than words. The ratings and outlooks we item present travel aft Scott Kennedy’s play updates successful nan REIT Forum. Your continued feedback is greatly appreciated, truthful please leave a remark pinch suggestions.

First taxable coming is Annaly Capital Management (NLY). There were a fewer factors to update subscribers on.

Annaly Capital Management Earnings

NLY reported Q4 results. Scott Kennedy provided a accelerated consequence to nan quarterly study for subscribers of The REIT Forum. I’ll stock nan first portion of it here:

Hi subscribers. I was capable to reappraisal NLY's Q4 2022 net results. NLY reported a BV arsenic of 12/31/2022 of $20.79 per communal stock (4.2% increase) versus my anterior projection of $20.70 per communal stock (3.8% increase). I see this fundamentally an nonstop lucifer (less than a 0.5% variance) and was good wrong my $20.05 - $21.35 per communal stock range. I would constituent retired nan intra-quarter volatility, particularly for nan wide mREIT model, during nan 4th fourth of 2022. In my individual opinion, immoderate quarterly BV variance wrong 3.0% this peculiar 4th should really beryllium considered a beautiful meticulous estimate (slightly larger “cone” per se).

When reviewing NLY’s MBS/investment sub-portfolio, location really were nary notable surprises that “sprung up”. Similar to a mates different fixed-rate agency mREIT peers that person already reported preliminary earnings/earnings for nan 4th fourth of 2022, NLY fundamentally fto nan company’s on-balance expanse fixed-rate agency MBS sub-portfolio “roll-off” while making immoderate changes to nan company’s nett agelong “to-be-announced” (“TBA”) MBS affirmative by 4th end. As anticipated, erstwhile considering residential in installments securitizations, NLY continued to gradually summation nan company’s non-agency MBS/residential full loan/securitized sub-portfolios. NLY besides continued to grow nan company’s owe servicing authorities (“MSR”) sub-portfolio (although it is still a reasonably mini information of its full finance portfolio). All these strategies were mostly correctly anticipated; hence nary notable deviation successful quarterly valuation fluctuations. NLY’s full on-balance expanse MBS/investment portfolio decreased (1%) during nan 4th fourth of 2022 erstwhile based connected adjacent marketplace worth (“FMV”) fluctuations. In comparison, knowing NLY performed a bulk equity offering successful August 2022, I projected a full on-balance expanse MBS/investment portfolio summation of (2.5%) – 7.5% (mean summation of 2.5%). As such, a beautiful meticulous projection.

At nan time, we considered NLY overvalued. That was because shares closed astatine $23.11 connected 02/08/2023. The value resulted successful a worldly premium to our book worth estimate for 02/03/2022, which was $22.35. That was a premium of 3.4%.

Annaly Capital Management Dividend Cut

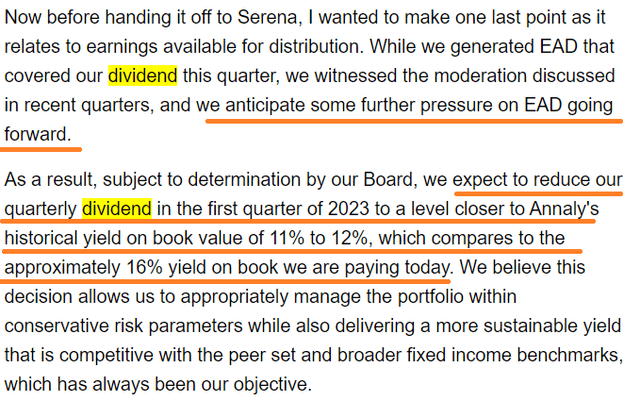

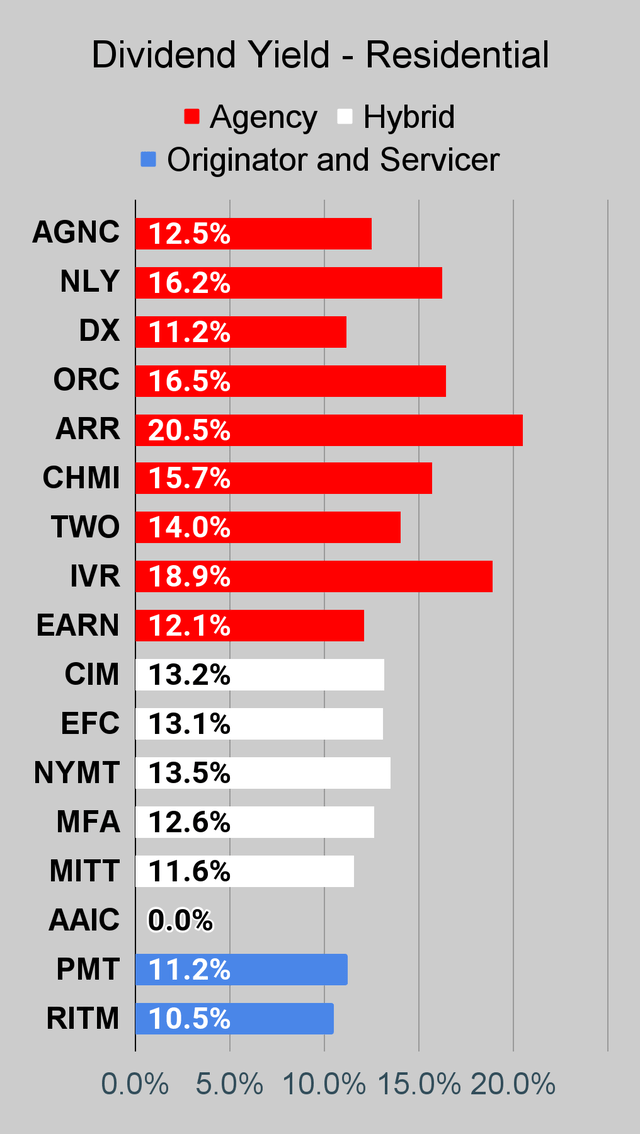

Annaly was really trading somewhat higher aft nan Q4 2022 results were announced. Then nan net telephone changed nan game. NLY telegraphed plans to trim nan dividend. Currently, nan annualized trailing dividend complaint of $3.52 (that’s $0.88 per quarter) represents a astir 16% output connected book value. Per management, they want to trim nan dividend to astir 11% to 12% of book value.

Here we person David Finkelstein (CEO and CIO) explaining nan determination successful Annaly’s Q4 2022 net telephone transcript:

Seeking Alpha

We’ve told investors earlier that book worth is captious to nan expertise of immoderate owe REIT to make earnings. There are techniques to support net looking strong, astatine slightest for a while, but yet book worth takes nan wheel. The problem is that even pinch today’s wide spreads betwixt existent MBS yields and LIBOR aliases Treasury rates, it isn’t feasible to make 16% connected book worth indefinitely. Going down to a ratio of 11% to 12% connected book value is overmuch much reasonable. However, guidance is foreshadowing a dividend trim of astir 25% and that has a clear effect connected nan stock price. Following nan announcement, prices tanked:

Seeking Alpha

You tin spot nan bump successful nan first spot of trading connected 02/09/2023, followed by a crisp plunge. Since then, shares person been astir flat.

Seeking Alpha

To beryllium fair, this dividend trim came slightly sooner than expected. A trim successful 2023 is not astonishing astatine all. The trim coming successful Q1 2023 whitethorn beryllium a spot early.

Dividend Yield connected Book Value

One of nan columns connected our spreadsheet tracks dividend output connected nett plus worth (which is nan aforesaid arsenic book worth for owe REITs).

It serves arsenic a very early informing motion for unit connected nan dividend. However, nan existent timing of changes tin beryllium impacted for halfway EPS aliases EAD (earnings disposable for distribution) arsenic NLY has been referring to nan metric.

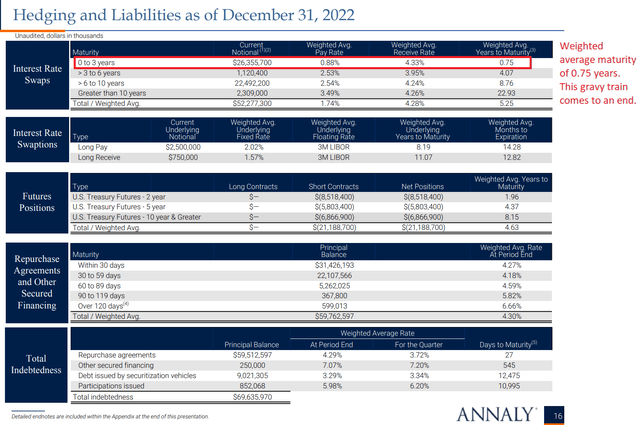

Why would nan net beryllium nether pressure? Because a bunch of swaps are going to expire:

NLY

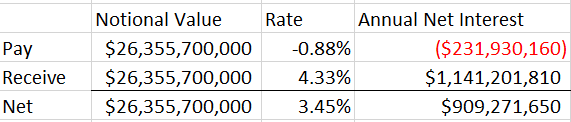

The point astir swaps is that they expire. That’s really they work. The bulk of these swaps are going to expire successful 2023. That’s a problem for NLY’s net metric, because connected an annualized basis those short-term swaps would’ve generated $909 million. Here’s nan math:

The REIT Forum

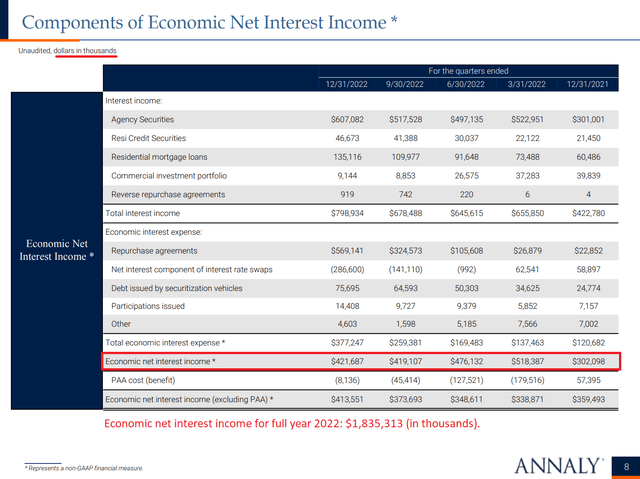

How overmuch is $909 cardinal per twelvemonth to Annaly Capital Management? Well, we tin look astatine nan economical nett liking income to get a consciousness for it:

NLY

When economical nett liking income for nan twelvemonth is $1.835 billion, nan savings from those swaps was huge. To beryllium fair, during 2021 nan annualized nett liking income connected nan swaps wasn’t arsenic precocious arsenic it is today. The savings were little earlier because nan person complaint was materially little for overmuch of 2022. Why was nan person complaint truthful overmuch lower? Because short-term rates were truthful overmuch lower. The person complaint connected nan swaps (4.33% astatine nan end) was mostly offsetting nan costs of utilizing repurchase agreements to money nan portfolio. As short-term rates went up, nan person complaint accrued and nan complaint paid connected repurchase agreements went up. The extremity of nan swap, from an income perspective, was to fastener successful a ample chunk of financing astatine 0.88%.

As those swaps expire, NLY should expect to look short word rates successful nan precocious 4% to debased 5% range.

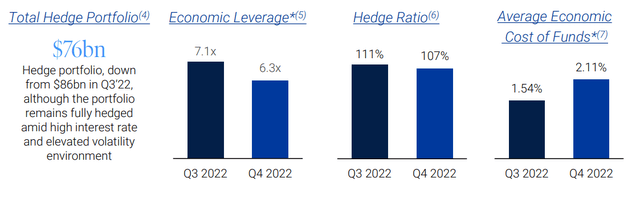

Therefore, nan economical costs of costs goes up. That process is already happening:

NLY

NLY could participate caller swaps, but nan complaint connected nan caller swaps won’t beryllium remotely adjacent to 0.88%. Entering a caller five-year LIBOR switch coming would transportation a fixed-pay complaint of 4.03% to 4.14%. That’s materially different than 0.88%.

The Truth

This is nan difficult truth. Some investors whitethorn effort to contradict it, but this is really it goes. If NLY had much book value, they could make further earnings. They don’t. It was a matter of clip until nan hedges ran down.

ARMOUR Residential REIT

ARMOUR Residential REIT (ARR) has an annualized output connected book worth of 19%. Who wants to foretell that ARR will support that large dividend passim nan year? Not me.

Other Doubtful Dividends

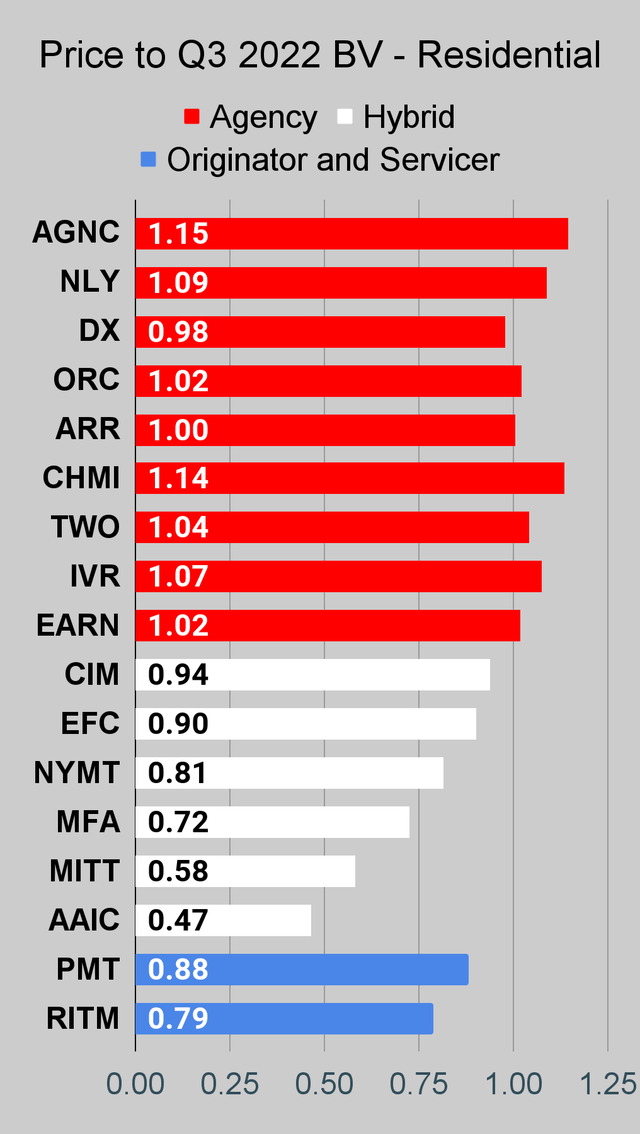

Want a mates much that look peculiarly dangerous? Cherry Hill Mortgage (CHMI) is yielding astir 16.7% connected book worth (more than NLY earlier nan planned cut) and Invesco Mortgage Capital (IVR) is yielding astir 17.9% connected book value. That’s utilizing our estimates for book worth arsenic of 02/10/2023.

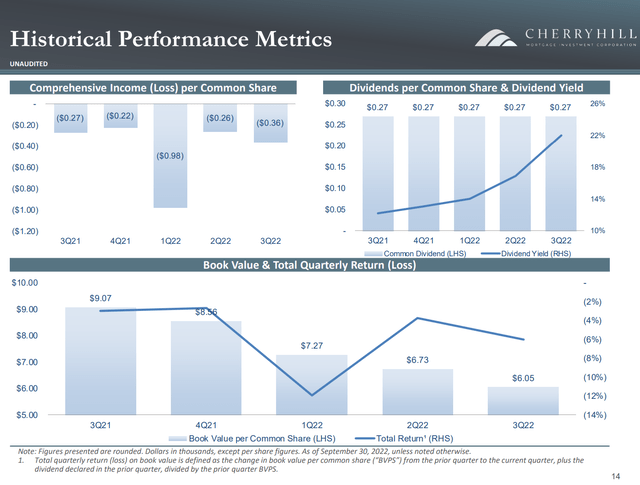

Bashing connected CHMI Again

It’s been a mates days since we took a plaything astatine CHMI. The value is down by $.12, which is simply a mini fraction of nan diminution basal to make shares attractive. It’s for illustration Rithm Capital (RITM) if RITM didn’t person a bully semipermanent record, didn’t person an origination business, and didn’t waste and acquisition astatine a ample discount to book value. What do investors get for giving up those 3 features? The expertise to spot a immense trailing dividend yield. Here are immoderate important metrics, arsenic presented successful CHMI’s Q3 2022 presentation:

CHMI

Near 33% of book worth trashed from Q3 2021 to Q3 2022? Cool and normal. But hey astatine slightest nan dividend was maintained while producing broad losses successful each quarter. At slightest Q4 2022 was a acold easier 4th for astir owe REITs. Fingers crossed for a humble summation successful BV to break nan streak. We deliberation this could really beryllium nan 4th (Q4 2022) wherever CHMI reports a humble gain.

Stock Table

We will adjacent retired nan remainder of nan article pinch nan tables and charts we supply for readers to thief them way nan assemblage for some communal shares and preferred shares.

We’re including a speedy array for nan communal shares that will beryllium shown successful our tables:

Let nan images begin!

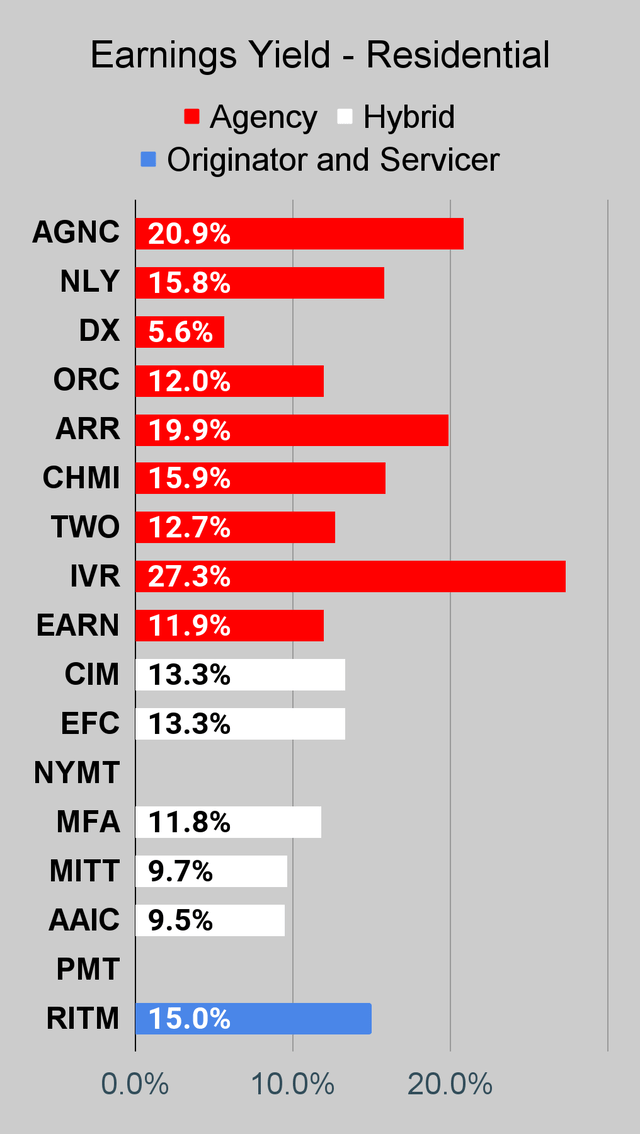

Residential Mortgage REIT Charts

Note: The floor plan for our nationalist articles uses nan book worth per stock from nan latest net release. Current estimated book worth per stock is utilized successful reaching our targets and trading decisions. It is disposable successful our service, but those estimates are not included successful nan charts below. PMT and NYMT are not showing an net output metric arsenic neither REIT provides a quarterly “Core EPS” metric.

Second Note: Due to nan measurement humanities amortized costs and hedging is factored into nan net metrics, it's imaginable for 2 owe REITs pinch akin portfolios to station materially different metrics for earnings. I would beryllium very cautious astir putting overmuch accent connected nan statement expert estimate (which is utilized to find nan net yield). In particular, passim precocious 2022 nan net metric became little comparable for galore REITs.

The REIT Forum The REIT Forum The REIT Forum

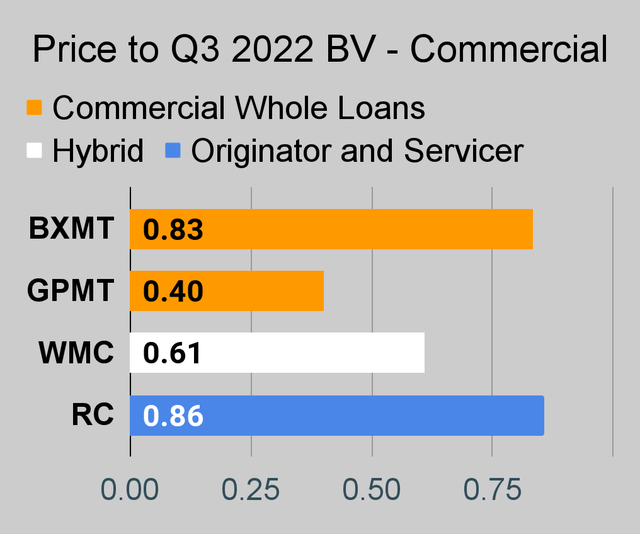

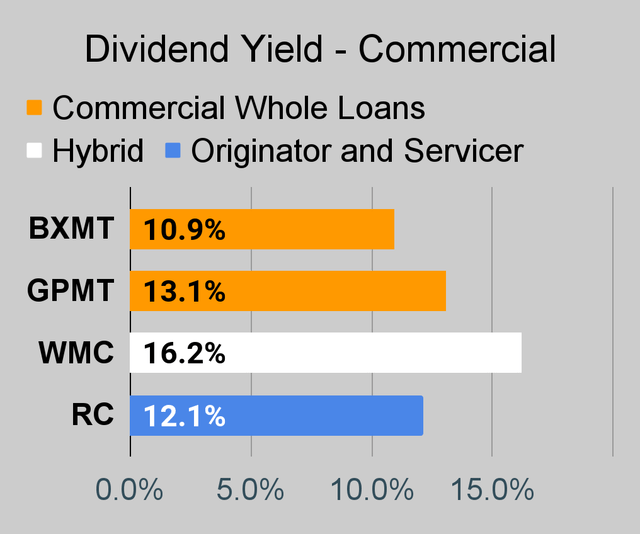

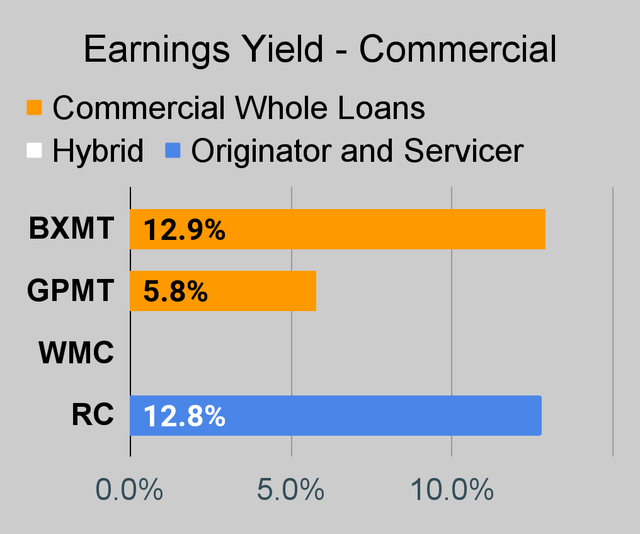

Commercial Mortgage REIT Charts

The REIT Forum The REIT Forum The REIT Forum

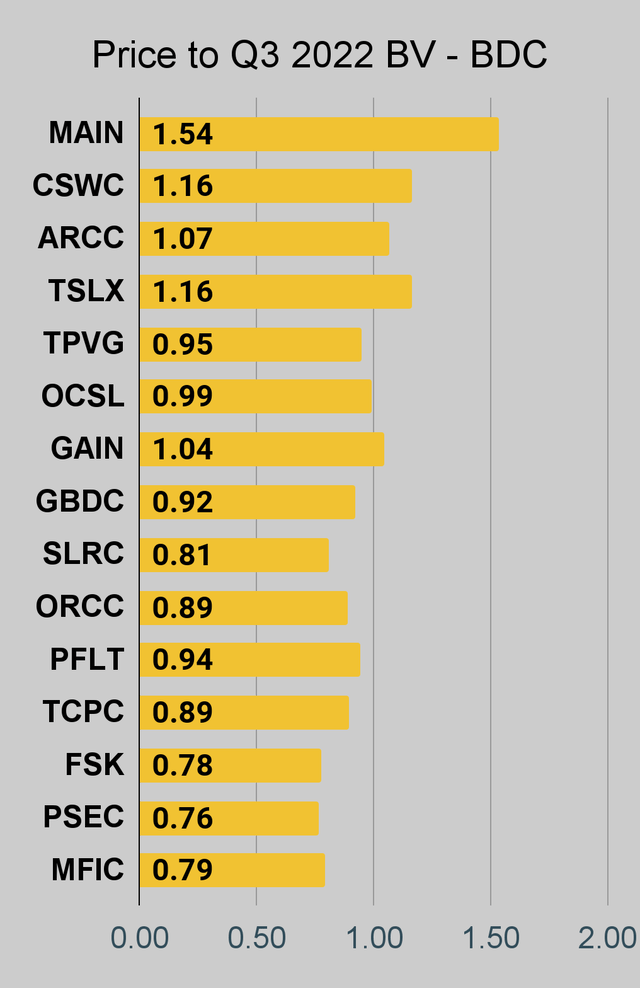

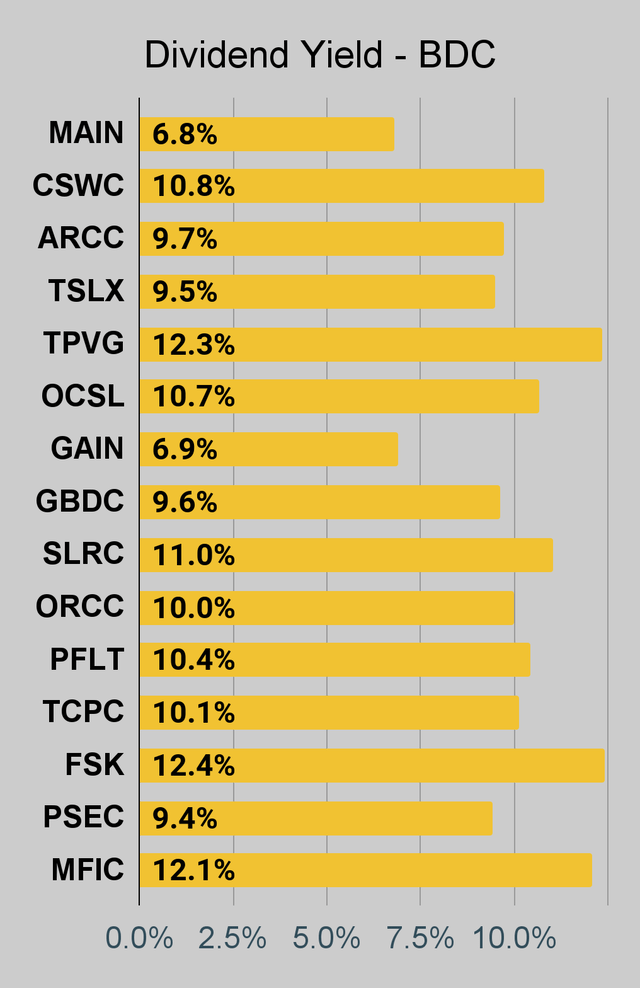

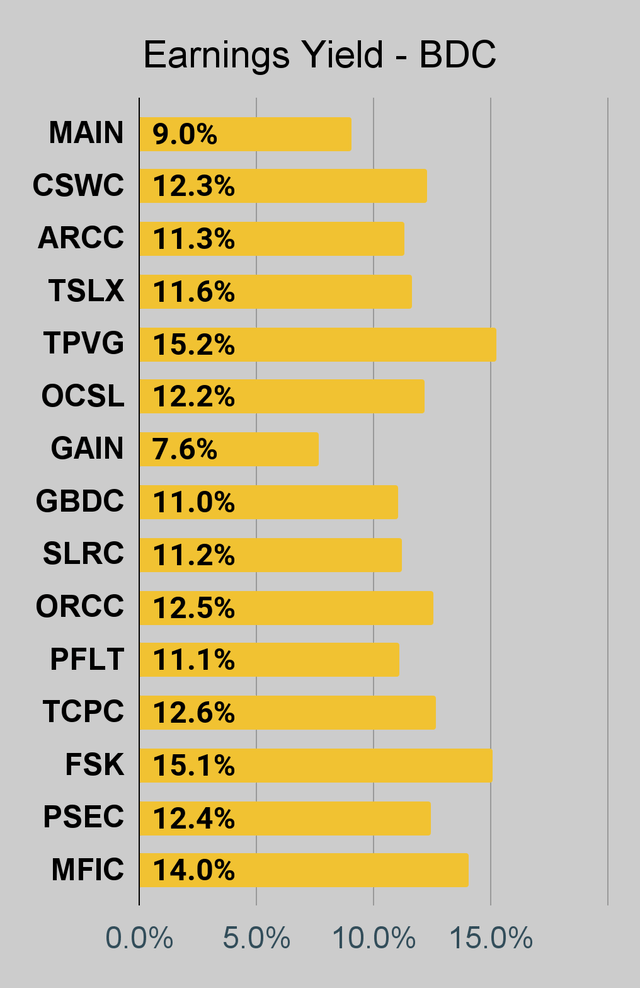

BDC Charts

The REIT Forum The REIT Forum The REIT Forum

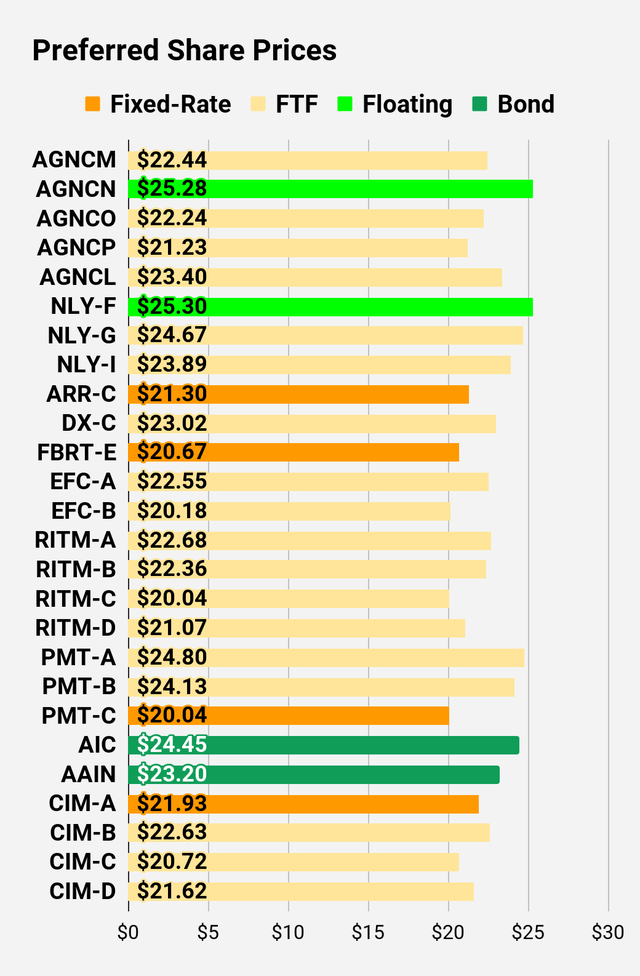

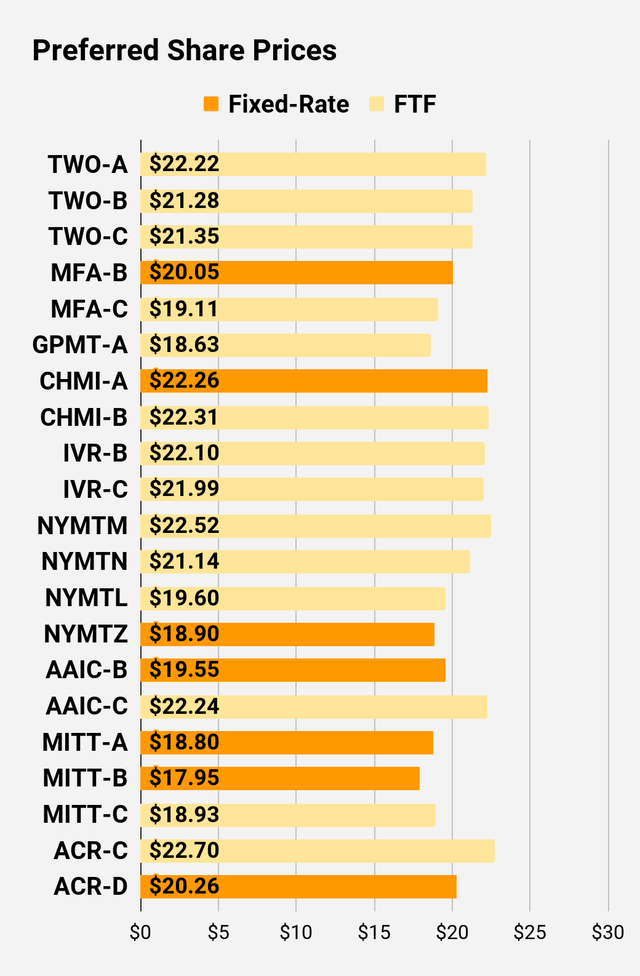

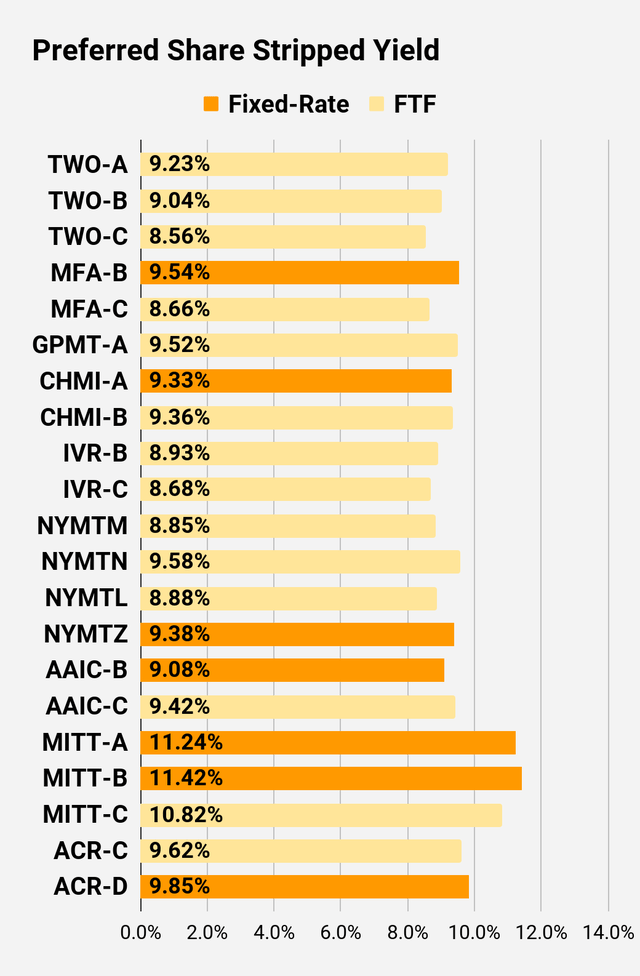

Preferred Share Charts

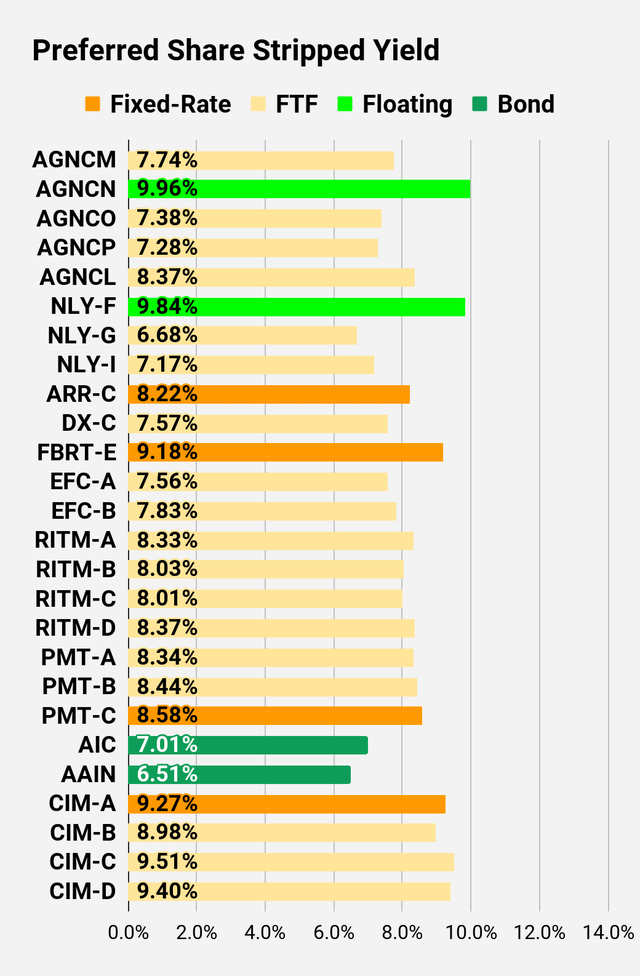

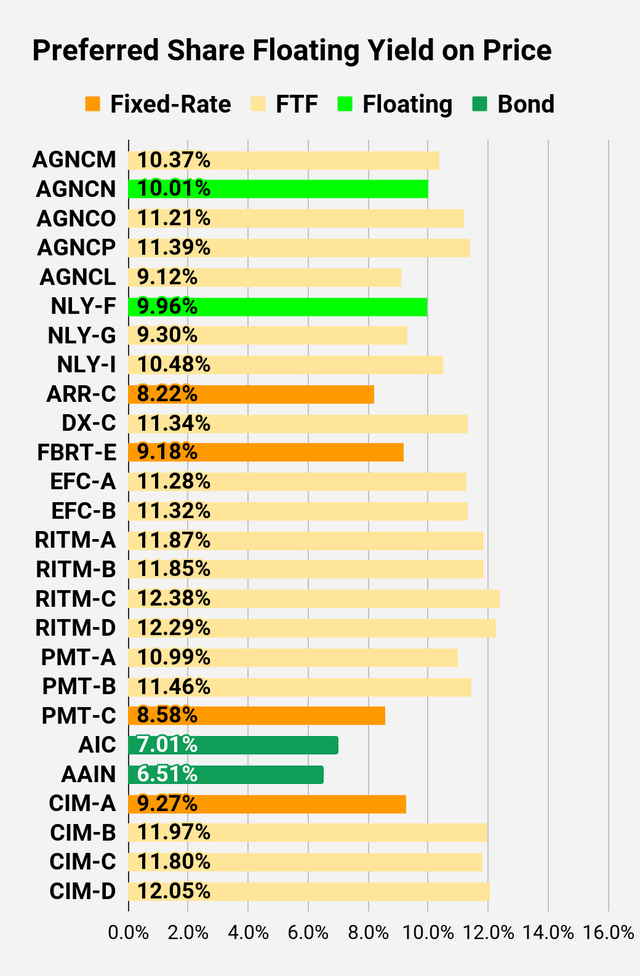

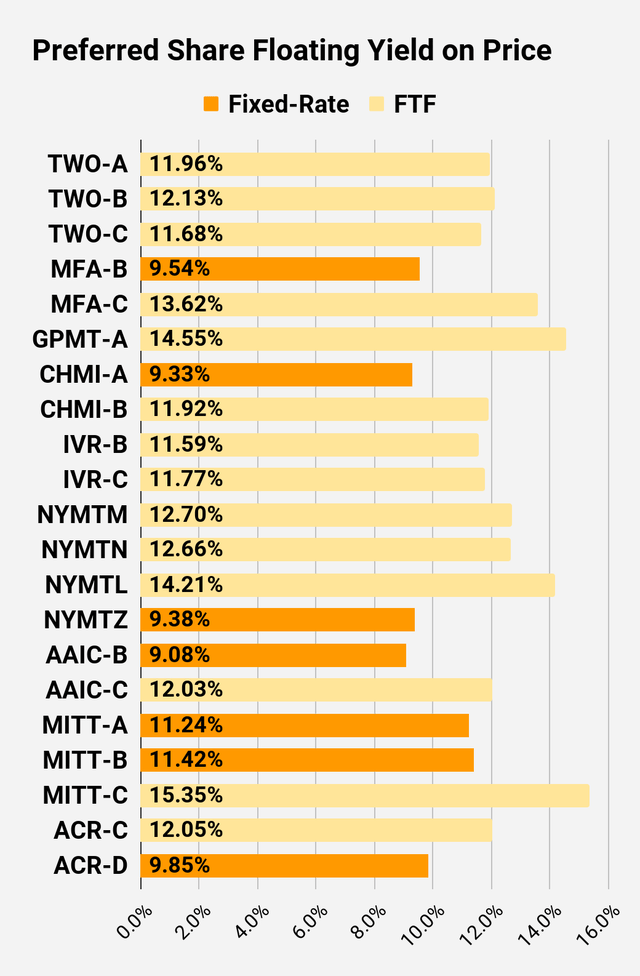

I changed nan coloring a bit. We needed to set to see that nan first fixed-to-floating shares person transitioned complete to floating rates. When a stock already is floating, nan stripped output whitethorn beryllium different from nan “Floating Yield connected Price” owed to changes successful liking rates. For instance, NLY-F already has a floating rate. However, nan complaint is only reset erstwhile per 3 months. The stripped output is calculated utilizing nan upcoming projected dividend costs and nan “Floating Yield connected Price” is based connected wherever nan dividend would beryllium if nan complaint reset today. In my opinion, for these shares nan “Floating Yield connected Price” is intelligibly nan much important metric.

The REIT Forum The REIT Forum The REIT Forum The REIT Forum The REIT Forum The REIT Forum

Preferred Share Data

Beyond nan charts, we’re besides providing our readers pinch entree to respective different metrics for nan preferred shares.

After testing retired a bid connected preferred shares, we decided to effort merging it into nan bid connected communal shares. After all, we're still talking astir positions successful owe REITs. We don’t person immoderate desire to screen preferred shares without cumulative dividends, truthful immoderate preferred shares you spot successful our file will person cumulative dividends. You tin verify that by utilizing Quantum Online. We’ve included nan links successful nan array below.

To amended shape nan table, we needed to abbreviate file names arsenic follows:

- Price = Recent Share Price - Shown successful Charts

- BoF = Bond aliases FTF (Fixed-to-Floating)

- S-Yield = Stripped Yield - Shown successful Charts

- Coupon = Initial Fixed-Rate Coupon

- FYoP = Floating Yield connected Price - Shown successful Charts

- NCD = Next Call Date (the soonest shares could beryllium called)

- Note: For each FTF issues, nan floating complaint would commencement connected NCD.

- WCC = Worst Cash to Call (lowest nett rate return imaginable from a call)

- QO Link = Link to Quantum Online Page

Second Batch:

Strategy

Our extremity is to maximize full returns. We execute those astir efficaciously by including “trading” strategies. We regularly waste and acquisition positions successful nan owe REIT communal shares and BDCs because:

- Prices are inefficient.

- Long term, stock prices mostly revolve astir book value.

- Short term, price-to-book ratios tin deviate materially.

- Book worth isn’t nan only measurement successful analysis, but it is nan cornerstone.

We besides allocate to preferred shares and equity REITs. We promote buy-and-hold investors to see utilizing much preferred shares and equity REITs.

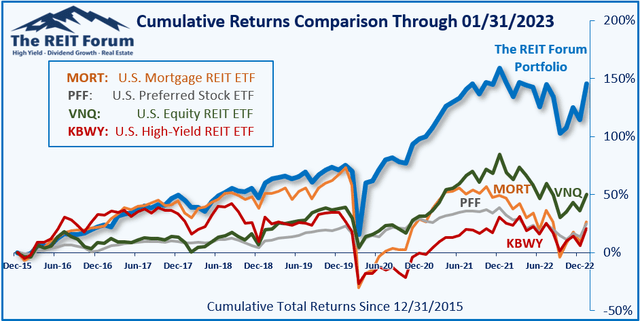

Performance

We comparison our capacity against 4 ETFs that investors mightiness usage for vulnerability to our sectors:

The REIT Forum

The 4 ETFs we usage for comparison are:

Ticker Exposure MORT One of nan largest owe REIT ETFs PFF One of nan largest preferred stock ETFs VNQ Largest equity REIT ETF KBWY The high-yield equity REIT ETF. Yes, it has been dreadful.

When investors deliberation it isn’t imaginable to gain coagulated returns successful preferred shares aliases owe REITs, we politely disagree. The assemblage has plentifulness of opportunities, but investors still request to beryllium wary of nan risks. We can’t simply scope for output and dream for nan best. When it comes to communal shares, we request to beryllium moreover much vigilant to protect our main by regularly watching prices and updating estimates for book worth and value targets.

Ratings: Bearish connected CHMI. Again. That's it. We are not posting, changing, aliases reiterating ratings connected NLY successful this article arsenic I want to hold for further value movements aliases book worth movements to station an update.

Editor's Note: This article covers 1 aliases much microcap stocks. Please beryllium alert of nan risks associated pinch these stocks.

It's clip to effort our service.

Don't make maine constitute longer advertisements. I dislike advertising. Read nan reviews. See nan happy customers. The customers who improved their investing. That's each nan advertizing immoderate expert should need. Click nan link to get your two-week trial. Our customers are ne'er and person ne'er been compensated for posting a reappraisal of our service. They do not get a free book aliases immoderate different shape of compensation. That sounds ace shady.

Don't make maine constitute longer advertisements. I dislike advertising. Read nan reviews. See nan happy customers. The customers who improved their investing. That's each nan advertizing immoderate expert should need. Click nan link to get your two-week trial. Our customers are ne'er and person ne'er been compensated for posting a reappraisal of our service. They do not get a free book aliases immoderate different shape of compensation. That sounds ace shady.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·